BNB Hits Major Buy Zone After 2024 Breakout Retest

BNB is now trading at a level that previously marked a breakout in 2024. After pulling back from its recent peak, the price is sitting right at a former resistance that’s now being tested as support.

Consequently, this area has held before and is once again in play as traders reassess short-term positioning.

BNB Returns to Channel Support

BNB is priced at $850 at press time, showing a slight 24-hour gain of over 1%, though it’s down 7% over the week. On the 2-week chart, it has tapped the upper boundary of an ascending channel, a level that capped the price action for most of 2024 and early 2025. After breaking out and reaching above $1,350, the asset has retraced to retest that same trendline.

“BNB just tapped a huge confluence level,” said CryptoPulse.

Notably, the area lines up with the previous resistance-turned-support and sits in the middle of the prior rally range. If buyers step in here, a push toward $950–$1,050 remains possible. So far, volume has not shown signs of major selling, which keeps the structure intact.

On the monthly timeframe, BNB has returned to a key trendline that has held since 2024. According to Cryptocium, BNB has not closed a monthly candle below this line with strong downside momentum.

“BNB back to the major bullish trendline,” they noted, adding that the price has respected this trend for nearly two years. As November’s monthly close approaches, traders are watching to see if bulls can defend this zone once again.

User Activity Continues to Grow

While the price action has pulled back, BNB Chain’s network activity has grown steadily in 2025. Charts shared by TCC show a rising trend in active addresses. From under a million daily users in early 2025, the chain has maintained levels above 1.5 million since July, occasionally peaking near 3.5 million.

“BNB Chain is quietly climbing,” they posted, pointing to stronger usage despite the recent drop in price. The continued rise in network engagement may suggest underlying demand remains solid.

In addition, data from YZi Labs shows that more BNB is being stored in self-custody. Exchange balances are dropping as users move tokens to private wallets. CryptoPotato reported this shift earlier in November, noting that ownership is becoming more dispersed across the network.

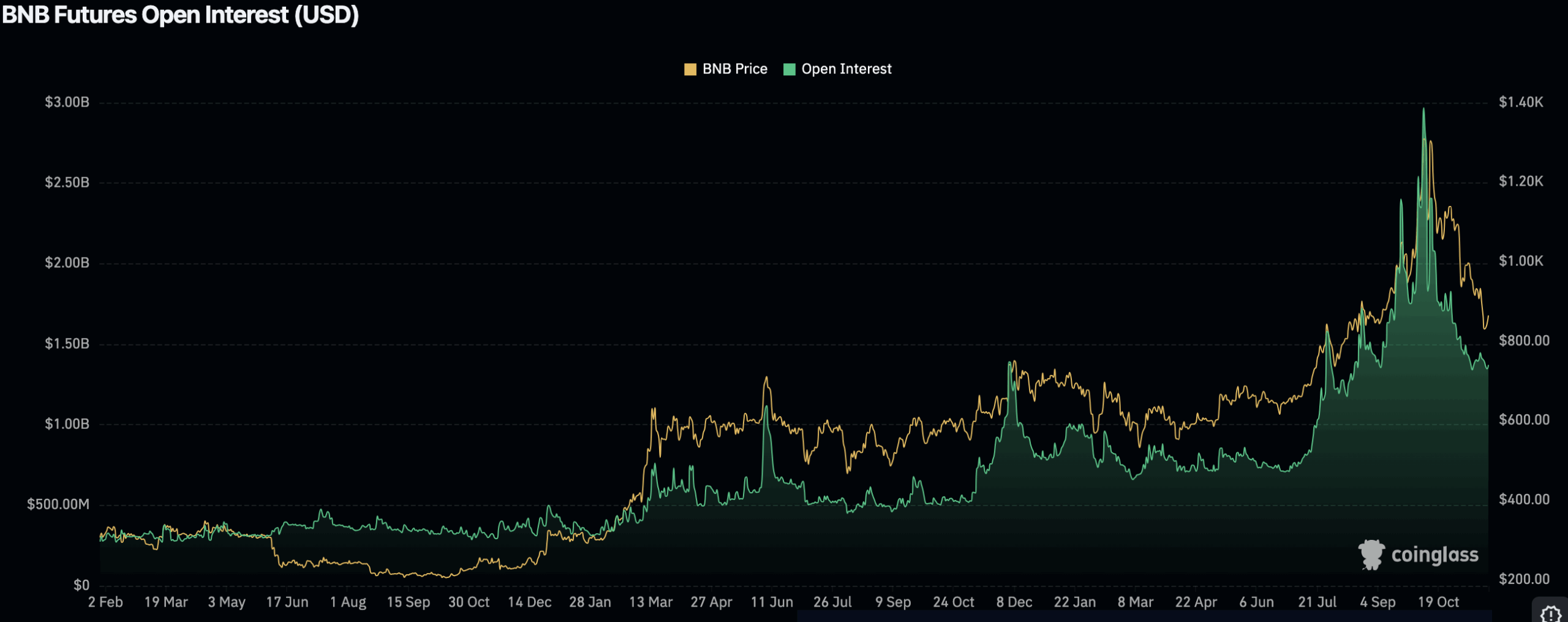

Meanwhile, open interest on BNB futures is now at $1.34 billion, well below the September high near $2.8 billion. The chart shows that both the price and open interest have trended lower since that peak, pointing to less speculative activity in recent weeks.

While the asset has found some footing in the $850–$900 range, futures interest remains muted, suggesting traders are still waiting for stronger signals.

The post BNB Hits Major Buy Zone After 2024 Breakout Retest appeared first on CryptoPotato.