Bitcoin Price Flashes Bottom Signal as Short-Term Holders Capitulate

Bitcoin price isn’t done just yet. But the state of Bitcoin news recently hasn’t been pretty.

Let’s look at my tragic track record for 2025:

- I didn’t make it with crypto.

- I didn’t make it with YouTube, TikTok, Twitch livestreaming.

- I didn’t even make it via cams and degenerate Onlyfans.

- I’m 28, Idon’t own a house, apartment, or even my own car.

It’s unironically over; everything I have ever tried to do in life has failed. But hey, we still have

0.57%

Bitcoin

BTC

Price

$86,940.02

0.57% /24h

Volume in 24h

$39.25B

Price 7d

!

Bitcoin may be trading in the high-$80K range, but thankfully, one of the market’s most consistent bottom indicators just fired again.

New CryptoQuant data shows the Short-Term Holder SOPR dropped to 0.94 in November, signaling that recent buyers have begun realizing losses despite BTC holding between $80K and $90K. Here’s what’s next for BTC:

DISCOVER: Next 1000X Crypto: 10+ Crypto Tokens That Can Hit 1000x in 2025

What’s Next For Bitcoin Price? Technical Structure Points to Compression Before Expansion

CryptoQuant reads the drop as simple loss-taking, not a break in the machine. When the SOPR dips below 1.0 it has followed the same script for years: fast sell pressure, rotation of liquidity, and a bounce once the panic sellers clear out.

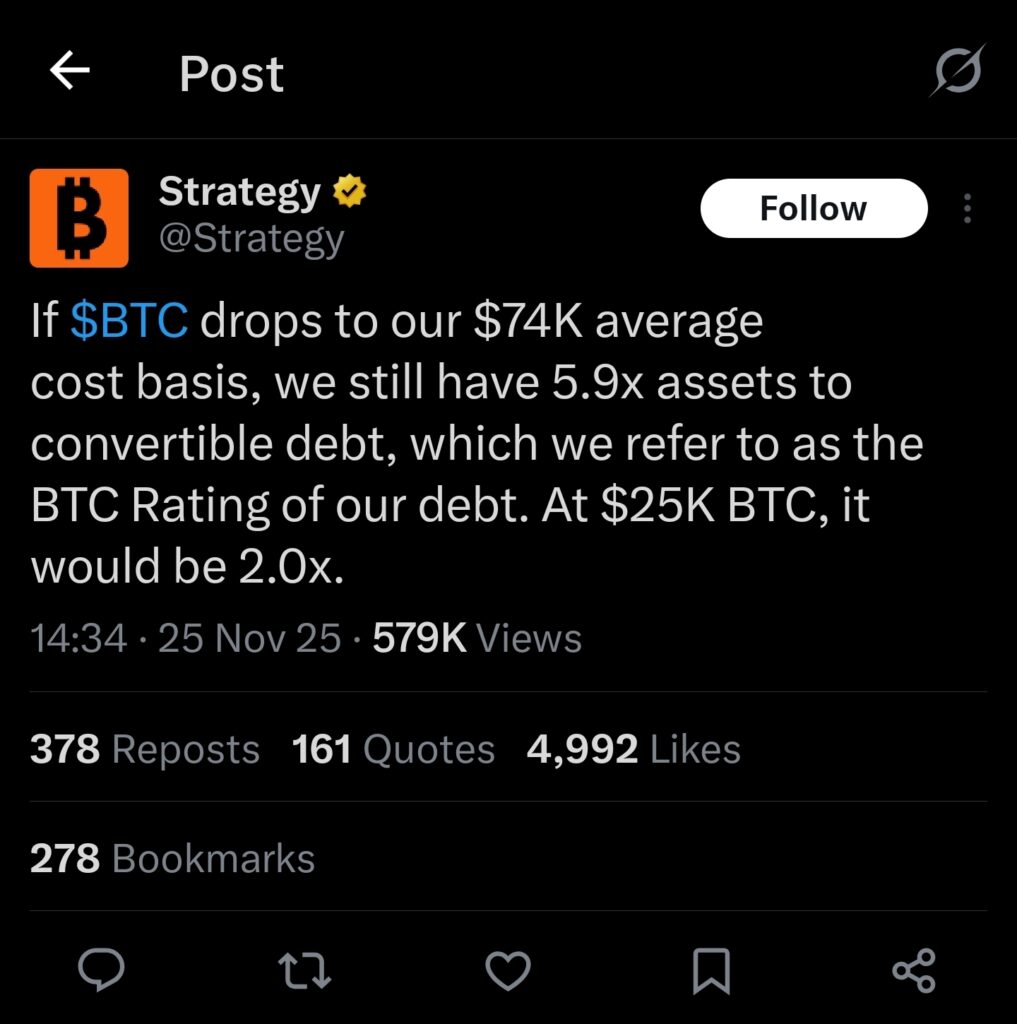

Moreover, it seems the MicroStrategy FUD that the company was insolvent is bunk. The company came out saying, “If $BTC drops to our $74K average cost basis, we still have 5.9x assets to convertible debt, which we refer to as the BTC Rating of our debt. At $25K BTC, it would be 2.0x.”

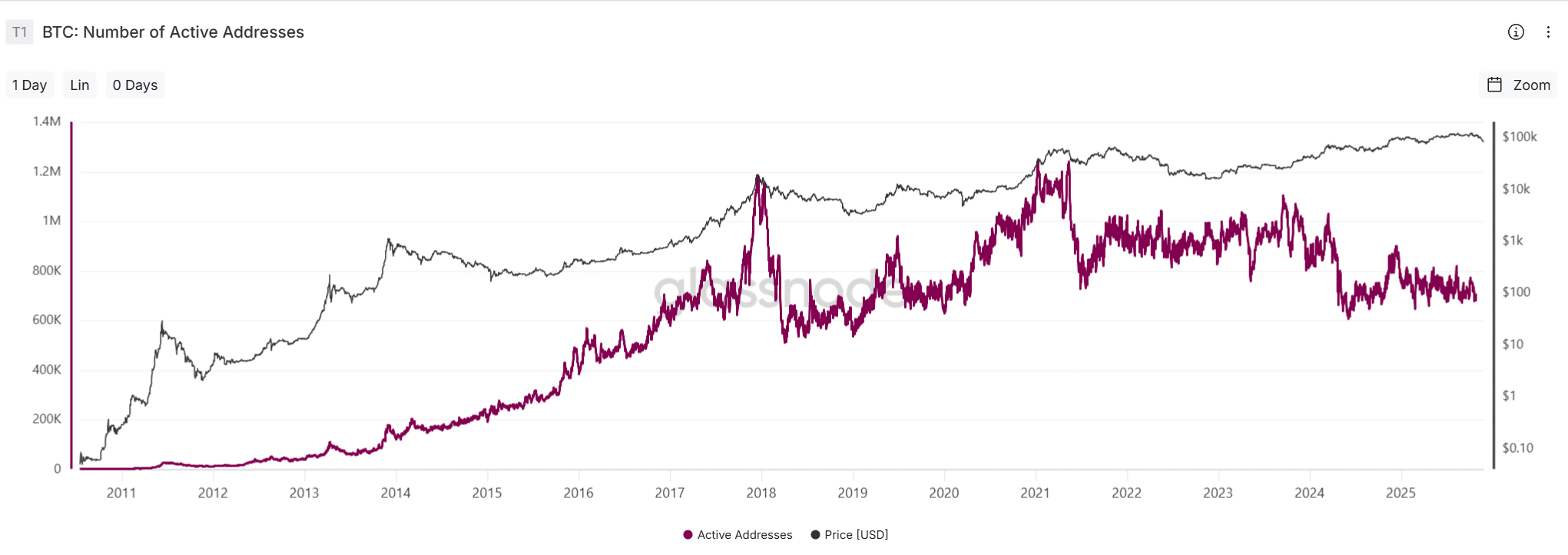

Glassnode’s numbers point the same way. Short-term wallets are dumping underwater, but long-term holders barely move. Exchange inflows tick up, yet outflows still lead. DeFi Llama shows open interest holding steady, a sign this wasn’t a derivatives unwind.

The broader backdrop fits as it stands. Traders are shifting toward a possible Fed easing cycle in early 2026. FRED data shows credit conditions loosening and Treasury volatility sliding from Q3 highs.

Will December Pump or Crash BTC USD Price?

On the technical side, BTC continues to grind inside a mild ascending channel. Higher lows support the structure even though momentum remains choppy.

Support sits between 86,900 and 87,200, with a deeper floor near 86,000 if pressure spills over. Resistance is at 88,200–88,500, and the real ignition point waits just above 88,900, where a clean break could flip momentum hard. BTC is holding just above the 20-day and 200-day SMAs, both stacked near 87,300.

Volume is thin, which means the next move won’t be subtle. A push through 89K confirms the break. Until then, the ascending channel keeps the structure intact, and the pressure points higher.

EXPLORE: Zcash (ZEC) Price Prediction 2025-2040

Join The 99Bitcoins News Discord Here For The Latest Market Updates

Key Takeaways

- The Bitcoin price isn’t done yet. But let’s look at my tragic track record for 2025:didn’t make it with crypto didn’t make it with YT…

- On the technical side, BTC continues to grind inside a mild ascending channel

The post Bitcoin Price Flashes Bottom Signal as Short-Term Holders Capitulate appeared first on 99Bitcoins.