Crypto Market Cap Shrinks By 6%, With Liquidations Surpassing $550 Million

The crypto market cap is down by 6%, with more than half a billion crypto bets liquidated amid flaring geopolitical tensions in the Middle East.

Tensions In The Middle East Rattle The Crypto Market

The total crypto market cap has dropped by 6%, sliding to $2.24 trillion at press time, as geopolitical tensions between Iran and Israel escalate. Yesterday, Iran launched ballistic missiles at key Israeli locations, causing the market to remain volatile as Israel vowed to retaliate in the coming days.

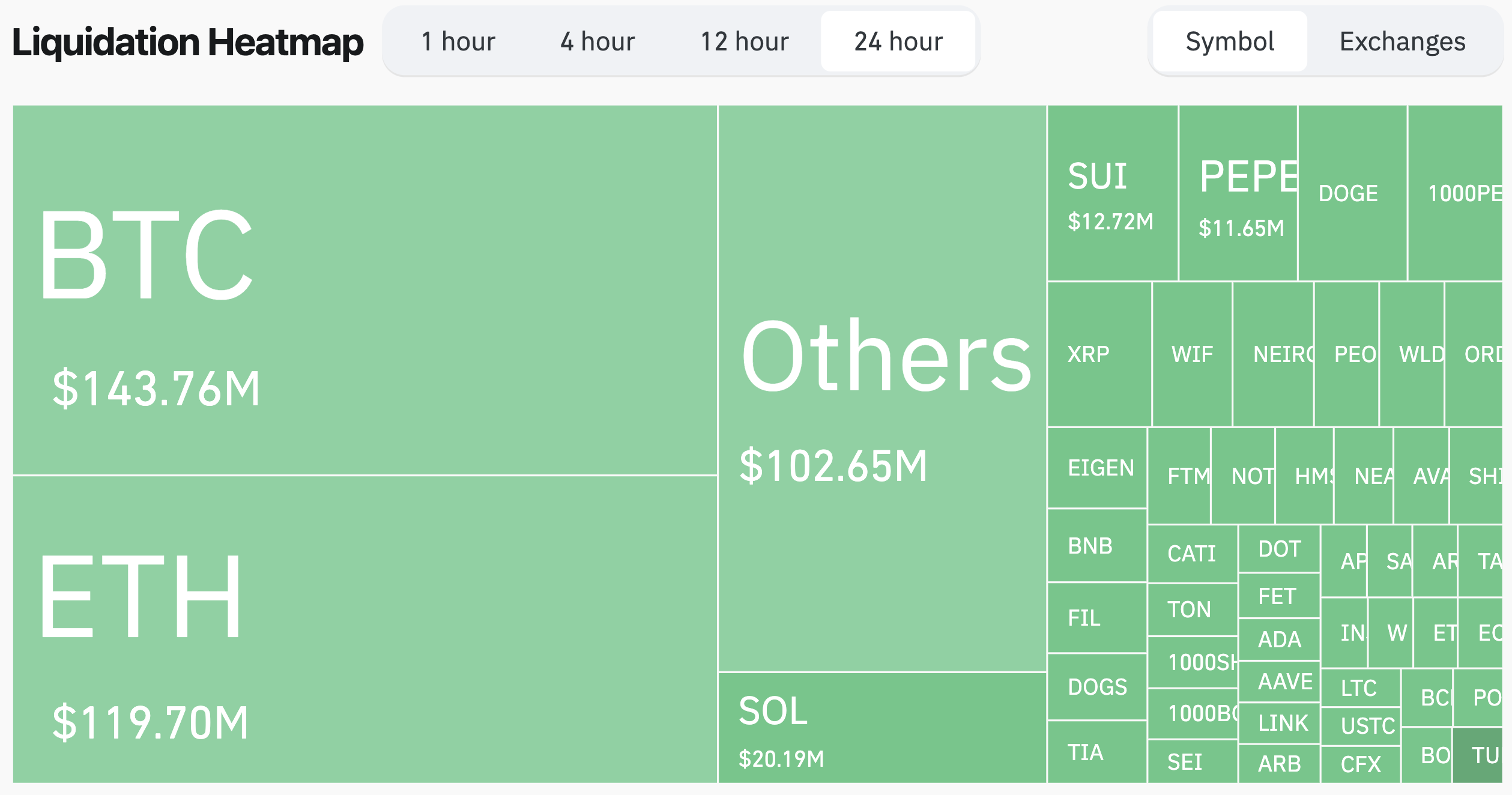

According to data from CoinGlass, more than $556 million worth of futures contracts were liquidated in the past 24 hours. Bitcoin (BTC), Ethereum (ETH), and Solana (SOL) saw liquidations worth over $143 million, $119 million, and $20 million, respectively.

Of the $556 million worth of futures contracts liquidated, 86.6% – or $482.2 million – were long positions, while the remaining 13.4% – or $74.6 million – were shorts. In total, 167,802 traders were liquidated in the past 24 hours, with the single largest liquidation order on Binance’s BTCUSDT pair worth $12.6 million.

Binance accounted for 49.1% of the total liquidations, with $273.4 million liquidated on the platform. It was followed by OKX, Bybit, and HTX, which saw liquidations totaling $182.6 million, $43.3 million, and $40.2 million, respectively.

For the uninitiated, crypto liquidations occur when a trader’s position is automatically closed by an exchange because they don’t have enough funds to cover potential losses or margin requirements.

Liquidations usually happen in leveraged trading, where traders borrow money to increase their position size. The exchange liquidates its assets if the market moves against them beyond a certain point to prevent further losses.

Large liquidations – as were observed in the past 24 hours – indicate high volatility in the market, often triggered by sudden price drops or spikes. They can suggest that many traders with leveraged positions were caught off guard by these volatile movements, leading to forced selling or buying. This can further amplify market instability as liquidations create cascading effects on prices.

It is worth highlighting that the majority – ranging from 83% to 99% – of these liquidations were long positions, indicating that traders expected asset prices to continue upward into October. Historically, October has been one of the most bullish months for BTC.

Bullish Sentiment Remains In The Market

With the recent drop in digital asset prices, October has not had the start the bulls hoped for. Since 2013, October has given negative returns on BTC only twice, making it a historically bullish month for digital assets.

Several crypto analysts maintain a bullish outlook for October and Q4 2024. For instance, a recent report by 10x Research noted that there are “exceptionally high” chances of a crypto rally before the end of the year.

Similarly, a report by Bernstein posits that a victory for Republican presidential candidate Donald Trump in the November US presidential elections could propel Bitcoin to as high as $90,000 in Q4 2024. BTC trades at $61,448 at press time, down 2.5% in the past 24 hours.