$6B Options Expiry Weighs on Ethereum Price

Bitcoin had a baby! Ethereum was born! And the Ethereum price is finally rebounding, up 3.9% over the last week.

Moreover,

0.22%

Ethereum

ETH

Price

$2,921.57

0.22% /24h

Volume in 24h

$10.74B

Price 7d

year-end fate is about to be decided by derivatives, not headlines. Roughly $6 Bn in ETH options expire Friday, and despite call options outnumbering puts by more than 2.2 times, the structure still favors bears unless price can reclaim key levels fast. Here’s what to know:

Ether’s $6B Options Expiry Puts Bulls on a Short Leash

ETH has failed to hold above $3,400 for more than 40 days, a stretch that has steadily drained bullish conviction. Most calls were placed between $3,500 and $5,000, reflecting expectations that Ether would close 2025 near $4,000 before the 28% November drawdown shattered that thesis.

As a result, more than $4.1 Bn in call options are now at risk of expiring worthless.

DISCOVER: Top 20 Crypto to Buy in 2025

History doesn’t repeat, but it often rhymes. $Ethereum is printing an identical fractal

we are currently in the ‘Final Loading Zone’ before the $5K+ expansion. pic.twitter.com/Mw8yn75cGJ

— 𝐊𝐚𝐦𝐫𝐚𝐧 𝐀𝐬𝐠𝐡𝐚𝐫 (@Karman_1s) December 24, 2025

Put positioning is more grounded. Bears clustered protection between $2,200 and $2,900 levels. If ETH settles between $2,700 and $2,900, puts win by roughly $580 Mn.

Even a $2,901 to $3,000 close still favors bears by $440 Mn. Bulls only reach parity above $3,100, with a modest $150 Mn advantage emerging above $3,200.

Derivatives flows explain the chop for the Ethereum price. ETH has hovered around $3,000 while dealers hedge exposure, keeping spot pinned inside a narrow band. If price holds above $2,950, more than 60% of $1.9 Bn in puts expire worthless, easing downside pressure but not flipping the trend outright.

DISCOVER: Next 1000X Crypto: 10+ Crypto Tokens That Can Hit 1000x in 2025

Why the Market Is Bracing for Later, Not Now

Crypto Fear and Greed Chart

1y

1m

1w

24h

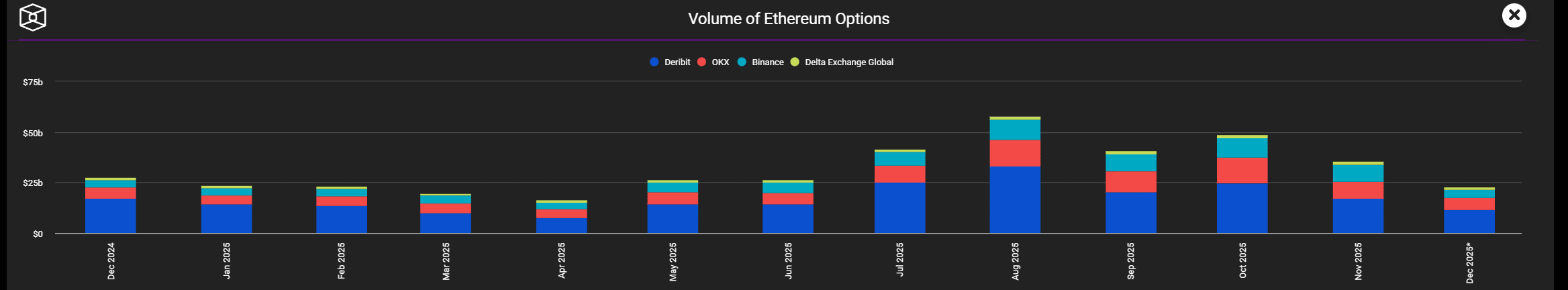

Ethereum options activity shows traders rolling exposure into late-2025 and 2026 expiries rather than loading up on shorts for this week. Similar positioning appeared in mid-2023 and early 2024 before delayed breakouts materialized.

Macro stress is adding caution. Additionally, weakness in US semiconductor manufacturing and softer AI-linked optimism have pushed traders toward hedges like bear put spreads and bear call spreads after repeated failures at $3,400.

The upshot is this: you are the Christmas miracle, Anon. You’re a beautiful and caring person and you have people who love you. Oh, and this week will be big for the ETH price; expect volatility.

EXPLORE: Singapore Denies Do Kwon’s $14M Refund Demand For ‘Stolen’ Penthouse

Key Takeaways

- ETH has failed to hold above $3,400 for more than 40 days, a stretch that has steadily drained bullish conviction.

- If price holds above $2,950, more than 60% of $1.9 billion in puts expire worthless.

The post $6B Options Expiry Weighs on Ethereum Price appeared first on 99Bitcoins.