Why Crypto’s Down Today? Prices Slip as U.S. Traders Go Risk-Off

Crypto prices slipped Tuesday as U.S. traders shifted into “risk-off” mode, pulling money from volatile assets. Bitcoin price dipped during U.S. trading hours, while ETH updates showed similar weakness across major altcoins. The move fits a broader pattern that has followed stocks lower since late 2025.

This was not about one bad crypto headline. It was about fear. When macro worries rise, crypto often feels it first. That context matters for beginners. It explains why prices fall even when no crypto project did anything wrong.

DISCOVER: Top Ethereum Meme Coins to Buy in 2026

What Does “Risk-Off” Mean for Crypto Beginners?

“Risk-off” is Wall Street shorthand. It means investors want safety. Think cash, government bonds, or gold. Crypto sits on the opposite end of that scale.

When U.S. traders go risk-off, they sell assets that swing hard. Crypto behaves like a turbocharged tech stock. When fear hits markets, prices usually drop fast.

During this pullback, traders pointed to renewed worries about a possible U.S. government shutdown and global tensions. Crypto followed stocks lower as U.S. trading turned defensive.

Why Are Bitcoin and Ethereum Reacting Together?

Bitcoin and Ethereum often move as a pair during macro-driven selloffs. Bitcoin price acts like the market’s anchor. When it slips, the updates usually follow.

This pattern shows crypto maturity. Big funds now trade Bitcoin through ETFs, just like stocks. When those funds cut exposure, outflows hit fast. That dynamic already showed up before. Bitcoin fell to around $80,500 late last year as ETFs saw near-record outflows and forced liquidations crossed $2 billiom.

A strong start to 2026, with liquidity momentum picking up fast.

Since early August 2025, global liquidity momentum has clearly slowed as, shown in the RoC metric.

Liquidity levels remained high, but momentum fell. This combination usually leads to risk-off, which is exactly… pic.twitter.com/k48r1NeDQq

— Alpha Extract (@alphaextract_) January 5, 2026

DISCOVER: Top Ethereum Meme Coins to Buy in 2026

How Should Regular Investors Read This Pullback?

This move says more about the mood than the fundamentals. Crypto still reacts to regulation, hacks, and adoption. But short-term price action now hinges on macro fear.

Clearer U.S. rules in 2025, including custody guidance and the GENIUS Act, improved the plumbing behind crypto markets. That structure did not disappear this week. Fear simply took the wheel.

At the same time, caution remains justified. DeFi exploits, like Balancer’s $128.6 million loss, remind investors that risk still lives inside the crypto stack. For beginners, the takeaway is practical. Zoom out. A pullback driven by U.S. trading fear differs from a crypto-specific failure.

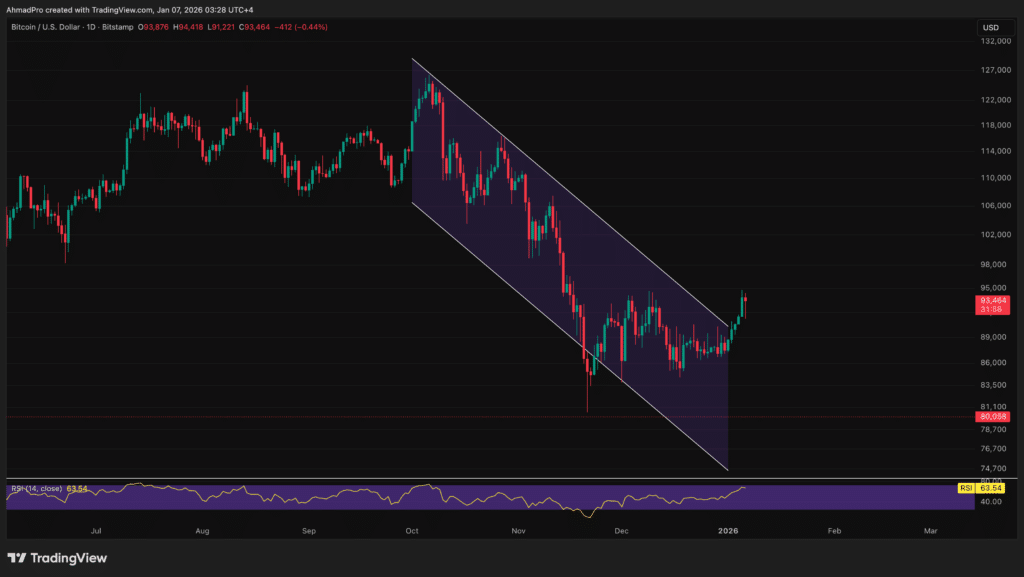

(Source: BTCUSD / TradingView)

If you hold long-term, this panic means nothing to you. Markets will keep testing nerves as 2026 unfolds. Understanding why prices move helps you stay calm when they do.

DISCOVER: Top Solana Meme Coins to Buy in 2026

Follow 99Bitcoins on X For the Latest Market Updates and Subscribe on YouTube For Daily Expert Market Analysis

The post Why Crypto’s Down Today? Prices Slip as U.S. Traders Go Risk-Off appeared first on 99Bitcoins.