Bitcoin Stuck Near $90K: Miners Say Don’t Expect a Breakout Yet

Bitcoin price prediction reportedly faces more sideways action after a major mining firm warned that prices may stay flat in the coming days. BTC has hovered near $90,000, roughly 30% below its October high of $126,000, with buyers and sellers stuck in a standoff. The bigger backdrop includes tight interest rates, shaky geopolitics, and investors rotating into safer assets like gold.

DISCOVER: Top Ethereum Meme Coins to Buy in 2026

Why Is Bitcoin Going Nowhere Right Now?

The prediction comes from BitRiver, a major Bitcoin mining firm that closely tracks market flows. Miners matter because they detect network activity, selling pressure, and investor demand before it appears on price charts.

In plain English, Bitcoin is in a holding pattern. Analysts call this a consolidation phase, which is like a stock trading in a narrow range while everyone waits for new information. Bitcoin has done this for about 195 days, one of its longest quiet stretches on record.

Bloomberg analysts project Bitcoin ETFs reaching over $1 TRILLION in assets.

IS THIS INSTITUTIONAL DEMAND AT A HISTORIC SCALE? pic.twitter.com/GhcSIsfgNZ

— Toxic Bitcoin Maxi

(@toxicmaxi21) January 12, 2026

So what’s missing? Fresh money. Institutional investors have pulled cash from spot Bitcoin ETFs, with $1.37 billion leaving between January 6 and 9 alone. When big players step back, price momentum fades.

What Does This Mean for Everyday Bitcoin Buyers?

If you’re new to crypto, a flat market can feel boring or worrying. Historically, though, long quiet periods are normal for Bitcoin. Past cycles in 2013, 2017, and 2021 all spent months moving sideways before big rallies.

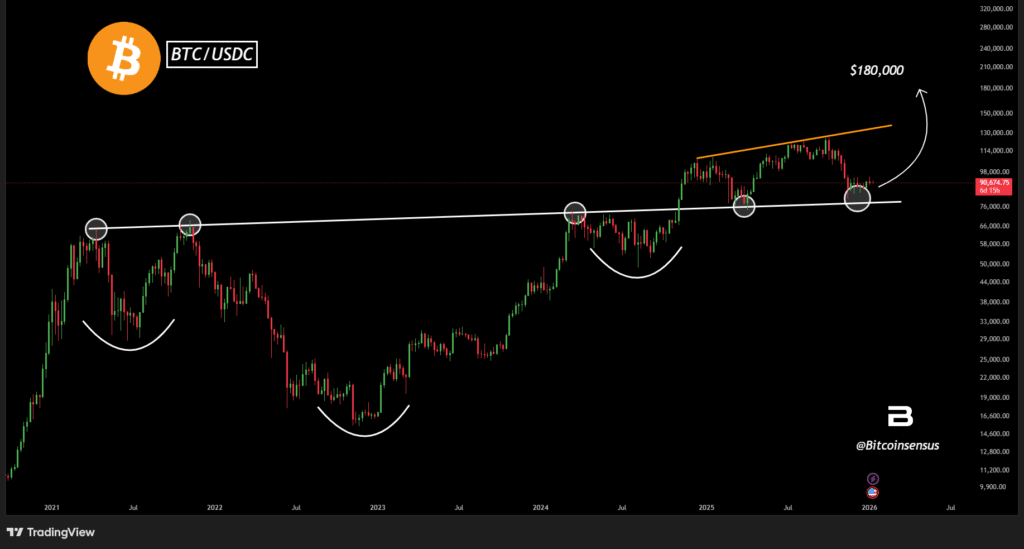

(Source: Bitcoinsensus)

Right now, investors watch two outside forces. First, interest rates. High rates make safe savings accounts attractive and pull money away from risky assets like crypto. Second, geopolitics. Rising global tensions push capital toward gold, which recently surged above $4,500 an ounce.

This explains why Bitcoin often moves with stocks. When stock traders freeze, crypto traders wait too. BitRiver says many market players now refuse to make big moves until equities pick a direction.

DISCOVER: Top Ethereum Meme Coins to Buy in 2026

Why the Long-Term Bitcoin Story Hasn’t Changed

Strategy has acquired 13,627 BTC for ~$1.25 billion at ~$91,519 per bitcoin. As of 1/11/2026, we hodl 687,410 $BTC acquired for ~$51.80 billion at ~$75,353 per bitcoin. $MSTR $STRC https://t.co/5UttS1LCy2

— Michael Saylor (@saylor) January 12, 2026

Stagnation does not equal failure. On-chain data shows reduced panic selling and less forced liquidation. That signals patience, not collapse. Analysts also note that Bitcoin supply growth slowed after the 2024 Bitcoin halving, which cut new coin issuance in half.

Some forecasts still lean bullish. Other analysts expect Bitcoin to benefit if the U.S. dollar weakens or if institutions return through spot Bitcoin ETFs. One London-based crypto group even predicts a strong move later in 2026.

That said, this is not a get-rich-quick moment. Flat markets punish impatient traders and reward disciplined buyers who understand risk.

The Risk Check Beginners Should Not Ignore

Bitcoin remains volatile. A move above $95,000 could spark fast gains, but sharp drops remain possible if global stress worsens. This is why never investing rent or emergency money matters.

For beginners, the smartest move often looks boring. Learn how cycles work. Set rules. Use dollar-cost averaging instead of chasing headlines. Quiet markets test nerves before they reward patience.

For now, Bitcoin waits. When money flows back into risk, the calm rarely lasts long.

DISCOVER: Top Solana Meme Coins to Buy in 2026

Follow 99Bitcoins on X For the Latest Market Updates and Subscribe on YouTube For Daily Expert Market Analysis

The post Bitcoin Stuck Near $90K: Miners Say Don’t Expect a Breakout Yet appeared first on 99Bitcoins.