First Time in 3 Months: Bitcoin Fear and Greed Index Signals Greed

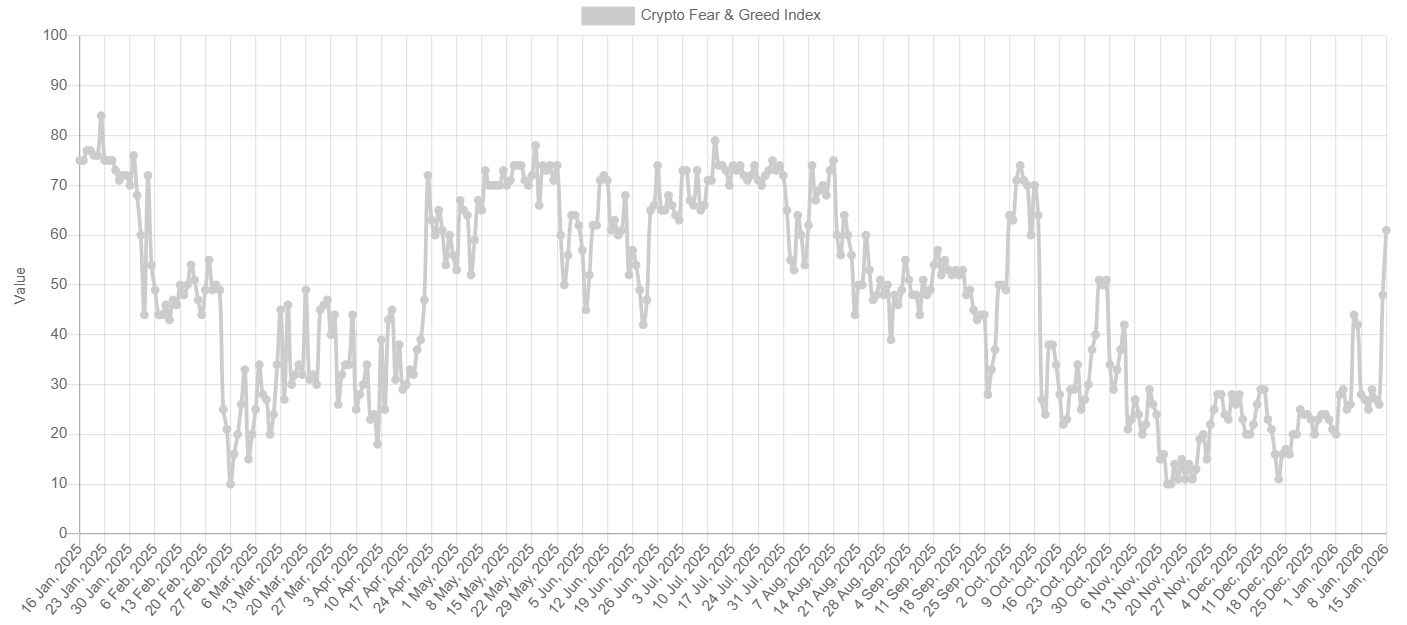

The metric that shows the general investor sentiment toward the leading cryptocurrency, the BTC Fear and Greed Index, has finally entered “greed” territory after spending the past three months mainly in the “fear” or “extreme fear” zones.

This development signals increased confidence and a growing appetite for the asset, but it may also be a precursor to a potential short-term pullback.

Back to ‘Greed’

The past few days have been more than positive for the BTC bulls as the asset’s price briefly surged to a two-month peak of almost $98,000. This spike came on the back of increased geopolitical tension after the USA first launched a military operation in Venezuela and later threatened to intervene in Iran, where the local population has organised massive protests against the regime.

Just recently, the American president Donald Trump eased his tone, claiming that violence in the Asian country has stopped and promised not to order an attack. The announcement caused little to no volatility in BTC, which currently trades around $96,000, up 7% on a weekly basis.

Somewhat expected, the asset’s rally has affected the popular Bitcoin Fear and Greed Index – a metric that tracks numerous segments, such as price volatility, surveys, and social media comments, to determine the momentary investor sentiment towards the cryptocurrency.

It has increased to 61, thus entering “greed” territory for the first time since the beginning of October last year. This might sound like further good news for the bulls since it reflects stronger confidence and demand in the asset.

On the other hand, it could also mean that some investors are driven by FOMO rather than fundamentals, suggesting the market can become overheated. In some cases, reaching the “greed” and especially the “extreme greed” zone might be a sign that the price has tapped a local top and is on the verge of a correction.

Further Pump on the Horizon?

Many market observers stand firmly in the bullish corner, expecting BTC’s price to continue rising in the near future rather than head south. X user Jelle believes a jump to $100,000 could occur in the coming weeks, whereas Ali Martinez previously predicted that an ascent above $94,500 may be followed by a spike to as high as $105,921.

Meanwhile, whale and shark addresses that own between 10 and 10,000 BTC have collectively accumulated more than 32,600 BTC since January 10. At the same time, shrimp wallets that hold less than 0.01 BTC have been on a selling spree. According to the analytics platform Santiment, this could be a perfect setup for a bull run.

The post First Time in 3 Months: Bitcoin Fear and Greed Index Signals Greed appeared first on CryptoPotato.