Crypto Market News Today, January 23: Bank Can’t Handle $14 Billion Withdrawal! What Crypto Learns From Davos

The crypto market is looking calm today. Bitcoin is steady just under $90,000. Ethereum crypto, although it drops by 10% this week, looks ready to benefit from the Davos talks of tokenization. Davos is exposing cracks in the old system while accidentally advertising the new one. Bitcoin talk engagement rate is starting to climb during this low sentiment market.

Davos has become a good vehicle for crypto with settlements, collateral, liquidity, and withdrawals, words that decide who survives the next financial shock. As panels are wrapping up, it is clear that crypto is efficient, and time is all it needs.

Davos and the $14 Billion Stress Test Crypto Endured

One of the biggest talks at Davos came from CZ, Binance co-founder, who casually dropped a number that shook traditional bankers. $14 billion in net outflows after the FTX collapse, with $7 billion gone in a single day. Banks, on the other hand, he implied, would buckle under similar pressure, while crypto processed it.

In a single week, Binance processed $14B in withdrawals.

All without freezing access or breaking flow.@cz_binance highlighted this at Davos as a live proof of crypto infra under real stress.

Few traditional banks could stay solvent under that kind of load.

Transparency, full… pic.twitter.com/alIJYJuko4

— nezuko ♡ (@nezukodefi) January 22, 2026

Coinbase CEO Brian Armstrong is also fueling the argument by pointing out something rarely thought about. Banks lend out your money without asking.

Just before that, he also had a sharp exchange with the Bank of France governor. Armstrong framed Bitcoin as a ledger of accountability, especially for countries dealing with inflation-fueled deficit spending. Armstrong highlighted that Bitcoin is decentralized with no single entity controlling it during the argument, as opposed to what the French Bank’s governor is trying to propose.

JUST IN: Coinbase CEO calls out Franch Central Bank governer:

“Bitcoin doesn’t have a money printer. It’s more independent” pic.twitter.com/2eW02mEaCy

— Bitcoin Magazine (@BitcoinMagazine) January 21, 2026

DISCOVER: 10+ Next Crypto to 100X In 2026

Tokenization and Machines

Tokenization in crypto-dominated Davos. We saw leaders talk about real assets, real settlements, and real efficiency gains. CZ, again, even floated a future where AI agents transact using crypto rails, skipping cards and banks entirely because automation does not need middlemen.

Crypto stablecoins are in the show too at Davos. Stablecoins are framed not as speculative tools but as backend infrastructure, and are already processing more volume than Visa and Mastercard. Circle’s Jeremy Allaire argued that yield-bearing stablecoins aren’t a threat to sovereignty but a competitive edge. Ripple’s Brad Garlinghouse called the debates “spirited.”

Spirited dialogue during today’s WEF session (to say the least), but one important point of agreement across the panelists was that innovation and regulation aren’t on opposite sides.

I firmly believe this is THE moment to use crypto and blockchain technology to enable economic… https://t.co/4d3jNeNC4h

— Brad Garlinghouse (@bgarlinghouse) January 21, 2026

Real-world assets now sit around $28 billion in DeFi TVL, with projections stretching into the trillions by 2030. Ethereum benefits, naturally, especially with JP Morgan being live on Ethereum.

BREAKING:

J.P. Morgan, the world’s largest bank, is now live on Ethereum.

The official RWA product is My OnChain Net Yield Fund (“MONY”), powered by JPM Kinexys.

Tokenization isn’t theory anymore.

It’s bank-grade financial infrastructure. pic.twitter.com/NwFJMgwehw— Merlijn The Trader (@MerlijnTrader) January 22, 2026

Regulation, Reality, and Momentum

Regulation replaced rhetoric. CZ warned that global rules won’t be one-size-fits-all. Finance isn’t a universal socket. Armstrong pushed stablecoin yields as a way to keep the US competitive with its dollar, while David Sacks tied crypto leadership directly to AI dominance. Even banks joined the same path, with executives openly calling blockchain the future now.

DAVID SACKS: “AFTER THE MARKET STRUCTURE BILL PASSES, BANKS ARE GOING TO FULLY GET INTO CRYPTO”

Just in from Davos 2026.

Watch.

pic.twitter.com/FZvjKDyDGg

— SMQKE (@SMQKEDQG) January 21, 2026

The UAE earned praise as an innovation hub, privacy models shifted toward configurable compliance, and tokenized stocks hit record market caps. None of it felt speculative this time. At Davos, the tone towards crypto was practical, and it is bullish.

Past Davos meetings sold nothing; this one shipped blueprints for what’s next for crypto. In my opinion, if finance were plumbing, TradFi would still be arguing about pipe materials while crypto just reroutes the water.

DISCOVER:

Follow 99Bitcoins on X For the Latest Market Updates and Subscribe on YouTube For Daily Expert Market Analysis.

US Drops OpenSea Insider Trading Case: Could 2026 be the NFT Comeback year?

The US government dropped its insider trading case against former OpenSea NFT platform executive Nathaniel Chastain after an appeals court overturned his 2023 convictions for wire fraud and money laundering.

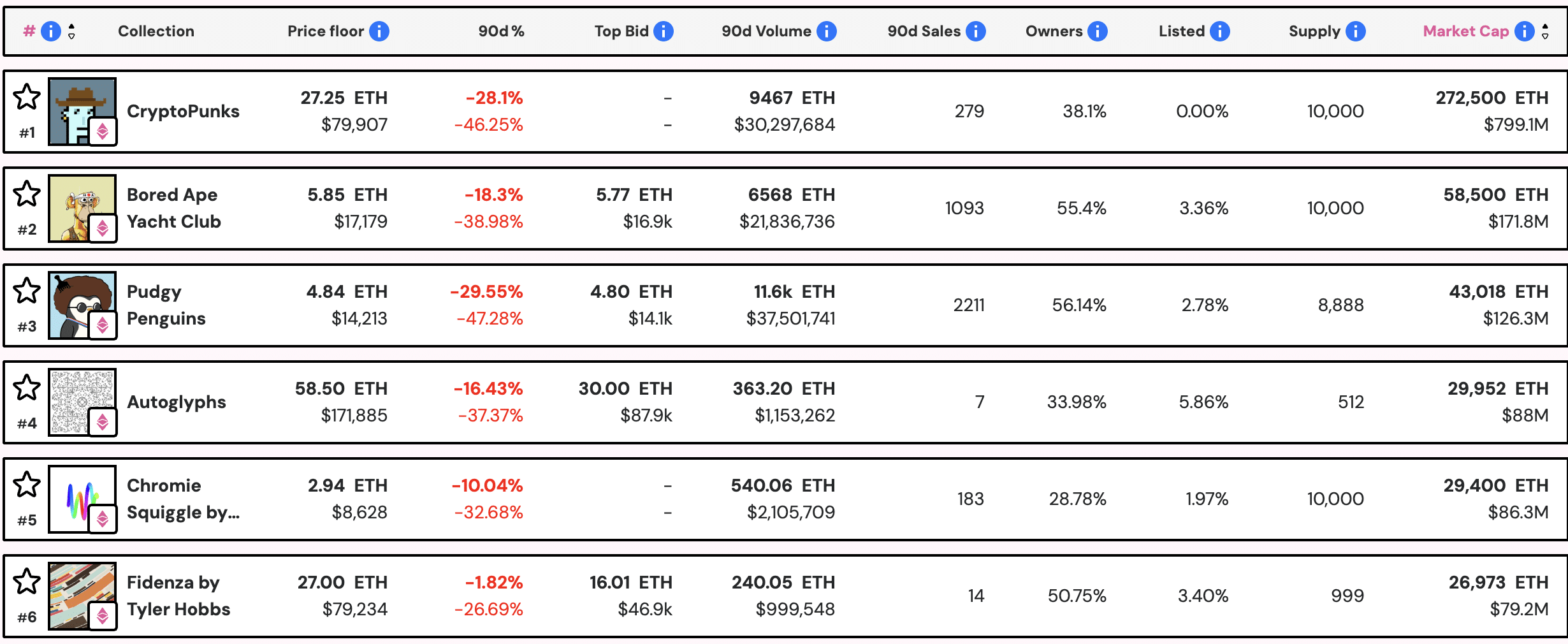

This case comes amid a multi-year bear cycle for NFTs, following their failure to sustain the hype of 2021-2022. The combined market cap for the NFT market sits just above $3Bn, down from over $420Bn in April 2022.

U.S. prosecutors have dropped all charges against former OpenSea product manager Nathaniel Chastain, bringing the first widely known “crypto insider trading” case to a close.

The decision follows a federal appeals court ruling that vacated his 2023 convictions for wire fraud… pic.twitter.com/69irBA77NY

— CryptoMoses (@realcryptomoses) January 23, 2026

To put it in further context, the most prominent NFT collection, ‘CryptoPunks’, has a current floor price of 27.25 ETH, down from 113.9 ETH, with regular trades in the multi-million-dollar range.

While this news is unlikely to spark a true NFT rally, it can only be viewed as a positive for the space, given the current poor price action; any crumb of good news surrounding OpenSea and the NFT space is welcome.

(SOURCE: NFTPriceFloor)

Read more about this here.

Coinbase Prepares for Quantum Threat as BTC USD Security Debate Heats Up

Coinbase has formed the Independent Advisory Board on Quantum Computing and Blockchain, convening leading experts in quantum science, cryptography, and distributed systems, to evaluate risks from future quantum computers to blockchain security and provide independent guidance to the ecosystem. All to protect our assets as BTC USD is trading at $89K, holding its support. For now.

Announced on January 21, 2026, the board will publish position papers assessing quantum impacts, issue recommendations for developers, users, and institutions, and respond to major scientific advancements.

This forms part of Coinbase’s broader post-quantum security roadmap, which includes updating address handling, key management, and Bitcoin product enhancements to mitigate vulnerabilities.

JUST IN: Coinbase announces a new quantum computing advisory board

The board will:

– Publish position papers on the state of quantum computing

– Issue guidance to users, developers, and institutions

– Respond in real time to major quantum breakthroughs pic.twitter.com/eE8GqOVAiD— Bitcoin Archive (@BitcoinArchive) January 22, 2026

Vitalik Says 2026 Is the Year to Ditch Big Tech: Bullish for ETH USD?

Ethereum cofounder Vitalik Buterin said 2026 will mark a turning point, with users reclaiming control over their digital lives by ditching Big Tech software such as Google Maps and Gmail.

ETH USD is down -3% in the past 24 hours, following Vitalik’s statement, suggesting the market viewed it as a long-term signal rather than a short-term price catalyst.

<p class=”p1″>

</p>

The broader crypto market continues to struggle this week amid global macroeconomic issues, as the combined crypto market cap slipped below $3.1 trillion in the past few hours. A loss of the $3 trillion level would be problematic, as it acts as an established safety net for the market.

The comments by the Ethereum co-founder come amid OG figures refocusing on privacy and decentralization amid heightened regulation and institutional control over the digital asset space.

2026 is the year we take back lost ground in computing self-sovereignty.

But this applies far beyond the blockchain world.

In 2025, I made two major changes to the software I use:

* Switched almost fully to https://t.co/caFP0K5fYF (open source encrypted decentralized docs)

*…— vitalik.eth (@VitalikButerin) January 22, 2026

Read the full story here.

Ledger Reportedly Eyes US IPO as Crypto Hacks Drive Wallet Demand

Crypto allows anyone to self-custody. That is, you can buy or mine Bitcoin or any other crypto asset, and move it to a secure, offline non-custodial wallet. Over the years, Ledger has emerged as a popular hardware wallet allowing thousands if not millions of crypto holders to secure their assets.

As more people take charge of their assets, not only is their confidence in the space improve, but they stay secure. In 2025, billions were lost when hackers struck centralized exchanges, stealing parked crypto assets, including the next cryptos to explode. In 2025, Bybit ended up losing over $1.3Bn of crypto assets to hackers allegedly sponsored by North Korea.

Considering the role played by cold wallet providers in crypto security, it is not surprising that the planned Ledger IPO in New York is drawing attention.

Read our full coverage here.

Coinbase Lets You Borrow Up to $1M Using Staked ETH

Coinbase has introduced a borrowing feature allowing eligible U.S. users to access up to $1 million in USDC loans using cbETH (staked Eth) as collateral. cbETH represents staked ETH on Coinbase, enabling users to retain ETH price exposure and staking rewards without selling assets. This avoids capital gains taxes associated with sales.

It also signals how fast crypto-backed lending is moving into the mainstream. Big platforms now package DeFi-style tools for regular users.

If you believe in somΞTHing, this one's for you.

ETH-backed loans are here.

You can borrow USDC against your Ethereum, unlocking liquidity without selling.

Available now in the U.S. (ex. NY). pic.twitter.com/eOvJ2BWPfr

— Coinbase 🛡️ (@coinbase) November 20, 2025

Read the full story here.

Bitcoin Price Liquidity Dries Up as $1Bn ETF Outflows Shake Prices

From Europe, South America, and the US, it is clear that Bitcoin and crypto are being institutionalized. The Bitcoin price, as a result, is heavily influenced by the big boys, so much so that retailers now play a minimal role.

This trend is expected to continue after the match was lit up in January 2024, when the US Securities and Exchange Commission (SEC), for the first time, approved spot Bitcoin ETFs. A few months later, spot Ethereum ETFs were given the green light, but without staking. Since then, the Bitcoin price has been defying gravity, breaking key resistance levels and moving to six figures in 2025.

US spot Bitcoin ETF cost basis acting like a floor..

Smart money defending their entry! pic.twitter.com/Zxx2kC4S9A— BACH (@CyclesWithBach) January 19, 2026

Since Wall Street is involved, and laws in the US are now pro-crypto, it is understandable that spot Bitcoin ETFs are closely monitored. After months of impressive inflows and choppy price action, cracks are beginning to emerge. The question now is: Will the Bitcoin price dive or, against expectations, soar to fresh all-time highs in the next few weeks?

Read more here.

Bitcoin USD May Enter Federal Reserve Stress Tests and Banks Feel the Heat

Bitcoin USD reportedly sits on the edge of the Federal Reserve’s 2026 bank stress tests, a move that would place crypto inside the same risk models as stocks and bonds.

The Bitcoin

price is trading this morning down -1.2% in the past 24 hours, now below $89,000, following a week of poor price action across crypto.

Bitcoin advocate Pierre Rochard just formally asked the Federal Reserve to treat BTC as its own variable in 2026 bank stress tests — citing 73%+ annualized volatility, massive drawdowns, and regime-shifting correlations that equities can’t proxy. Push for better risk modeling as… pic.twitter.com/hiAKLzqPeB

— Taurus – Bitcoin Bull (@Taurus4BTC) January 22, 2026

On a positive note for BTC, according to CoinGlass data, the BlackRock IBIT ETF surpassed $70Bn in market cap, further tightening its ties to the banking system and marking another milestone for the ETF space.

Zoom out, and this fits a bigger trend: US regulators are slowly treating Bitcoin less like a side experiment and more like a traditional financial instrument, and the money flowing in just proves it.

Read our in depth coverage here.

Bitcoin Price Liquidity Gap Widening: Big Boys Bought $1.2Bn But Retailers Sold

There’s something special that happened in January 2024. After years of hope and pain, the US Securities and Exchange Commission (SEC) approved the first nine spot Bitcoin ETFs. When this approval went through, Bitcoin, and by large, crypto as an industry, ushered in a new era.

No longer will Bitcoin and, by extension, some of the best cryptos to buy, be shaped by the whims of retail traders. Spot Bitcoin ETFs are regulated by the SEC, and that means institutions, often managing billions, if not trillions of investor funds, were free to dabble with the otherwise risky Bitcoin.

The reception was immediate and positive for Bitcoin and the entire crypto space. Not only did the Bitcoin price tick higher, soaring back towards the $70,000 level, a key resistance zone then, but institutions, almost immediately, started scooping up Bitcoin, channeling billions directly to the digital gold.

Read more here.

Circle Backs UN Stablecoin Hub to Speed Up Global Aid

The Circle Foundation recently announced a significant grant to support the United Nations’ Digital Hub of Treasury Solutions (DHoTS). Circle stablecoin will be used to deliver aid. This initiative aims to use regulated stablecoins to make humanitarian aid payments faster, cheaper, and more transparent.

This announcement took place at the World Economic Forum’s Annual Meeting in Davos on January 21, 2026, shining a light on how cryptocurrency technology can contribute to global humanitarian efforts.

By incorporating digital financial tools like stablecoins such as USDC, the partnership seeks to improve efficiency in a global aid system that handles over $38 billion annually, ensuring more funds reach those in need for essentials like food, medicine, and shelter.

“Modern humanitarian finance needs modern infrastructure – and we’re here to help make that happen.”

At @wef, Elisabeth Carpenter, Founding Chair of Circle Foundation, announced the foundation’s first international grant to support the @UN‘s Digital Hub of Treasury Solutions, a… pic.twitter.com/C49LyRk4jy

— Circle (@circle) January 22, 2026

Read our full coverage here.

Maple Finance Brings its Stablecoin to Base: Is Aave Crypto Up Next?

Maple Finance

has launched its yield‑bearing stablecoin, syrupUSDC, on Coinbase’s Base network and is claiming an Aave Crypto V3 listing is up next. Base has become one of the fastest‑growing Ethereum Layer‑2 networks, as DeFi activity rises amid users seeking cheaper fees.

The increase in DeFi activity comes as banks move to kill the CLARITY Act in the US, fearing that yield-bearing stablecoins will drain $6 trillion in banking deposits as investors chase higher returns offered by digital assets.

the banking lobby is trying to castrate the clarity act.

for one reason:

because they know crypto is the better product for the people.

the banks are scared. pic.twitter.com/HN1tsYutyN

— Phil Kwok | EasyA (@kwok_phil) January 22, 2026

The move fits a wider trend whereby institutional‑style yield products are spreading beyond Ethereum’s main chain into more beginner‑friendly networks such as Coinbase’s Base.

This ongoing story regarding stablecoins and the CLARITY Act comes as the crypto market fell -2% overnight, with the combined market cap falling to $3.1 trillion amid ongoing macroeconomic uncertainty. If you wish to learn more about this bill, my colleague Fatima covered the recent changes to the CLARITY Act draft last week.

Read the full story here.

The post Crypto Market News Today, January 23: Bank Can’t Handle $14 Billion Withdrawal! What Crypto Learns From Davos appeared first on 99Bitcoins.