BNB Crypto Challenges $915: Slight Gains Set Stage for Major Resistance Showdown

Binance Coin is pushing higher again, but the real test now sits at the $915 line.

Binance Coin (BNB) posted a small gain on Tuesday, trading near $873 as traders watched whether it could make another attempt at the $900-$915 zone.

As perIt rose about +1% in the past day, with a market value close to $119Bn. Price moved between an intraday high near $878 and a low just under $860.

DISCOVER: Next 1000X Crypto – Here’s 10+ Crypto Tokens That Can Hit 1000x This Year

What Does BNB’s $1.39B Futures Open Interest Say About Trader Conviction?

BNB is still far from last year’s peak above $1,000, when it briefly topped $1,100. But the $900–915 band has turned into an important ceiling.

It blocked rallies through late 2025 and even acted as support earlier this month before the price slid back below it.

Coinglass reported about $1.39Bn in BNB futures open interest in the last 24 hours, up just over +2%.

Futures volume dropped to around $393M. That points to traders adjusting or extending positions instead of taking bold new bets.

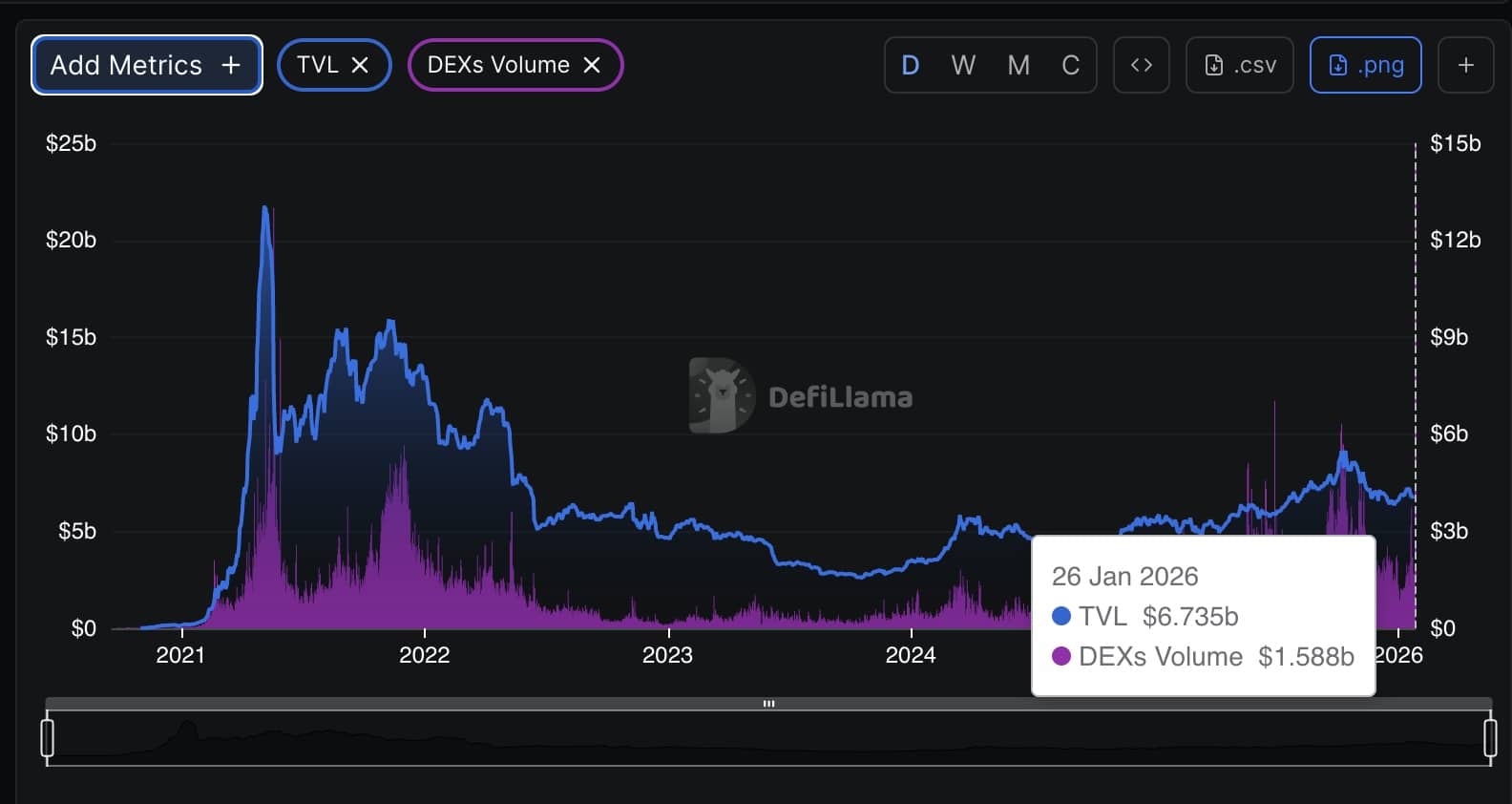

On-chain activity on BNB Chain showed steady participation over the past day. DEX volume came in near $1.68Bn, with perpetuals adding another $480M.

That gave BNB Chain close to 17% of the roughly $10Bn traded across major decentralized exchanges, based on data from DeFiLlama.

DISCOVER: 16+ New and Upcoming Binance Listings in 2026

BNB Price Prediction: What Does the Break Below the $930–$950 Range Mean for BNB’s Short-Term Trend?

The short-term chart still leans bearish. BNB continues to trade below a key consolidation zone on the 4-hour timeframe, which suggests sellers remain in control.

The token slipped out of a broad sideways range that has held since late December.

After failing to keep its footing near the $930–$950 region, price turned lower and moved back toward the bottom of the structure.

Current candles show fading momentum after a rejection at a small resistance band. That area sits between roughly $905 and $935, where several Fibonacci levels overlap.

$BNB

We should see a bounce next week and ideally test the micro resistance zone. pic.twitter.com/k78BFHmxw0— More Crypto Online (@Morecryptoonl) January 26, 2026

The reaction there signals that buyers are not yet strong enough to shift the short-term trend.

BNB’s chart shows a clear corrective ABC pattern forming inside a broader consolidation. The latest move looks like the final leg lower, with price now sitting just above the $860 zone.

This level has acted as support in recent sessions, and buyers are starting to show some early interest.

Even with the weak tone, the analyst said the setup could allow a short-term recovery.

“We should see a bounce next week and ideally test the micro-resistance zone,” he said, noting that the cluster of resistance overhead is the first area to watch if buyers step back in.

For now, the trend is still corrective. A brief bounce is possible, but BNB needs to reclaim resistance before momentum can shift in favor of the bulls.

DISCOVER: 10+ Next Crypto to 100X In 2026

Key Takeaways

- BNB trades near $873 as futures interest hits $1.39B, testing $900–915 resistance amid cautious trader positioning sentiment today.

-

Coinglass reported about $1.39Bn in BNB futures open interest in the last 24 hours, up just over +2%.

The post BNB Crypto Challenges $915: Slight Gains Set Stage for Major Resistance Showdown appeared first on 99Bitcoins.