Solana Recovers Above $125 as Traders Watch Key Levels

Solana climbed back above $125 after weeks of selling pressure, and traders treated the move as more than a quick bounce. Since then, SOL has been moving in a narrow band between $125 and $128, with buyers and sellers testing each other’s confidence. This is happening while the wider crypto market looks calm and steady rather than nervous.

Price never tells the whole story on its own. This level aligns with improving network health and rising interest from large investors, giving the move more weight than a random chart jump. Together, those factors change how beginners may want to think about SOL right now, with less guesswork and more patience.

Why $125 Stands Out for Solana

The $125 area sits above a recovery zone where sellers were in control earlier this month. In simple terms, buyers just showed they can defend higher prices instead of only stepping in after drops.

Traders also keep an eye on something called a moving average, which works like a monthly spending average for price. When a coin stays above it, buyers usually have the upper hand. SOL is now holding above its short-term average, which helps explain why confidence picked up.

If SOL moves past $128, the next hurdle is near $135. If it slips instead, prices often drift back toward $122. That range helps people decide when to enter or wait.

DISCOVER: 9+ Best High-Risk, High-Reward Crypto to Buy in January2026

Solana’s Rebound Goes Beyond Price

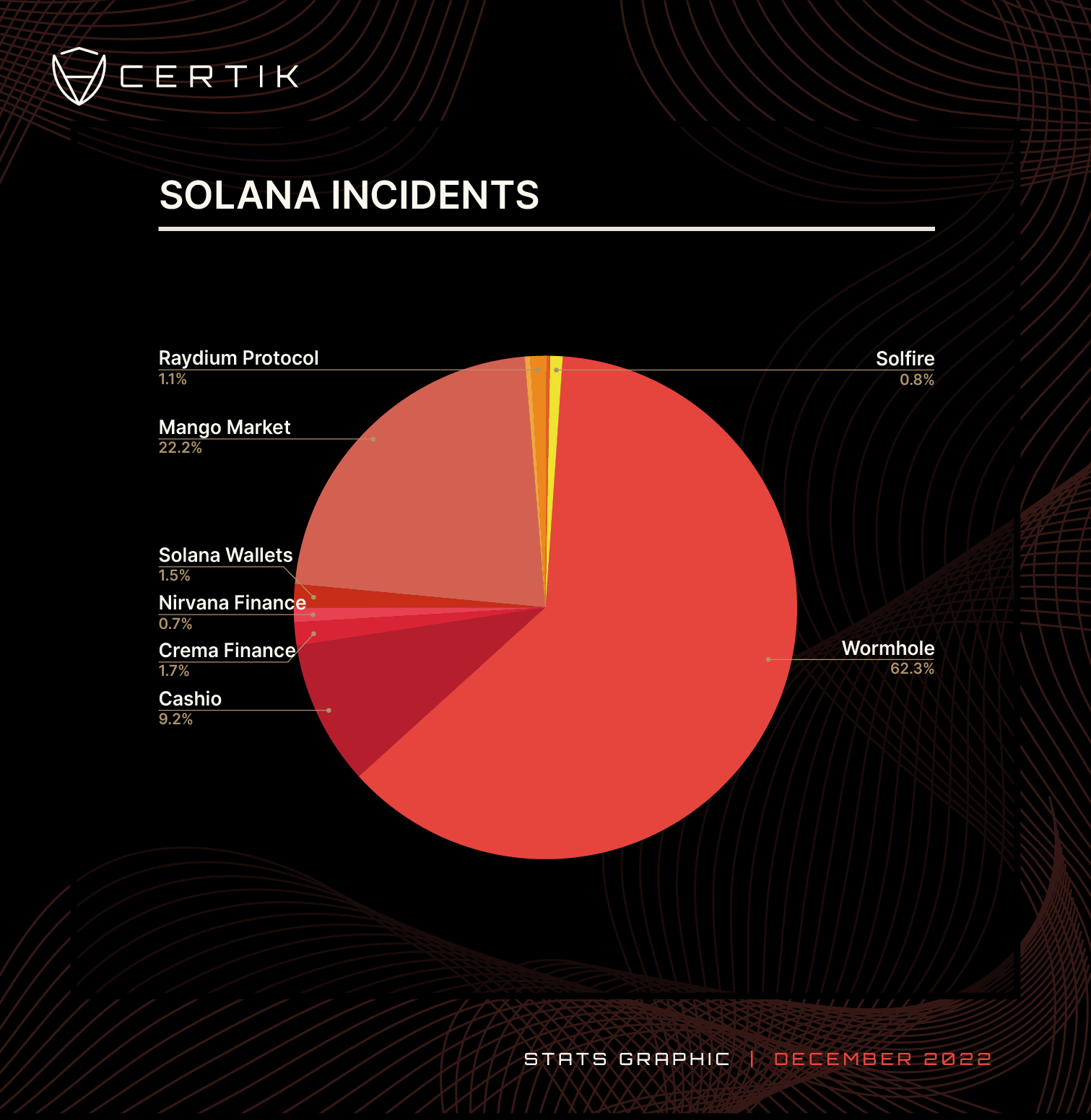

Back in 2022, Solana picked up a rough reputation after several outages and a major bridge hack. Trust took a hit, and many beginners still remember that period.

Today looks different. In early 2026, Solana handled more than 100 million transactions per day, up about 30% from the year before. That points to real use, not empty excitement. The network also avoided major security problems in 2025, which helped rebuild confidence.

Reliability improved as well. Co-founder Anatoly Yakovenko said Solana reached 99.99% uptime in 2025. For everyday users, that means fewer frozen apps and fewer stressful moments during busy periods.

Large Investors Are Quietly Stepping In

Big investors usually avoid chasing fast moves and prefer structure and stability. That helps explain why the approval of a Solana ETF in late 2025 drew attention.

An ETF works like a stock version of crypto, letting people invest without managing wallets or private keys. Since approval, products linked to SOL pulled in about $2 billion, showing steady long-term interest.

That flow of money supports the idea that the $125 zone is more than random noise, because it sits where larger players start paying attention.

DISCOVER: Best New Cryptocurrencies to Invest in 2026

What Beginners Can Take From This

Start by zooming out. Solana’s rebound looks stronger than earlier attempts because network usage, reliability, and external investment have all improved. That does not remove risk, but it does lower it compared to a few years ago.

It also helps to avoid chasing sudden green candles. Buying closer to support levels like $122 to $125 can reduce regret if prices swing again, which they often do.

Finally, keep position sizes reasonable. Never use money you need for everyday life, since altcoins can move sharply even when the outlook seems positive.

If this pace holds, SOL begins to look less like a dramatic comeback and more like a system that is running smoothly again. The next few weeks will show whether buyers defend this level or step aside.

DISCOVER: 20+ Next Crypto to Explode in 2025

Follow 99Bitcoins on X for the Latest Market Updates and Subscribe on YouTube for Daily Expert Market Analysis

The post Solana Recovers Above $125 as Traders Watch Key Levels appeared first on 99Bitcoins.