SOL USD Slides to April 2025 Lows as Global Risk Assets Unwind

Solana’s SOL token slid to $101, its lowest level since April 2025, as a broad sell-off hit crypto, tech stocks, and even gold. The SOL USD price cracked after Bitcoin lost $80,000, prompting investors to panic and sell risky assets.

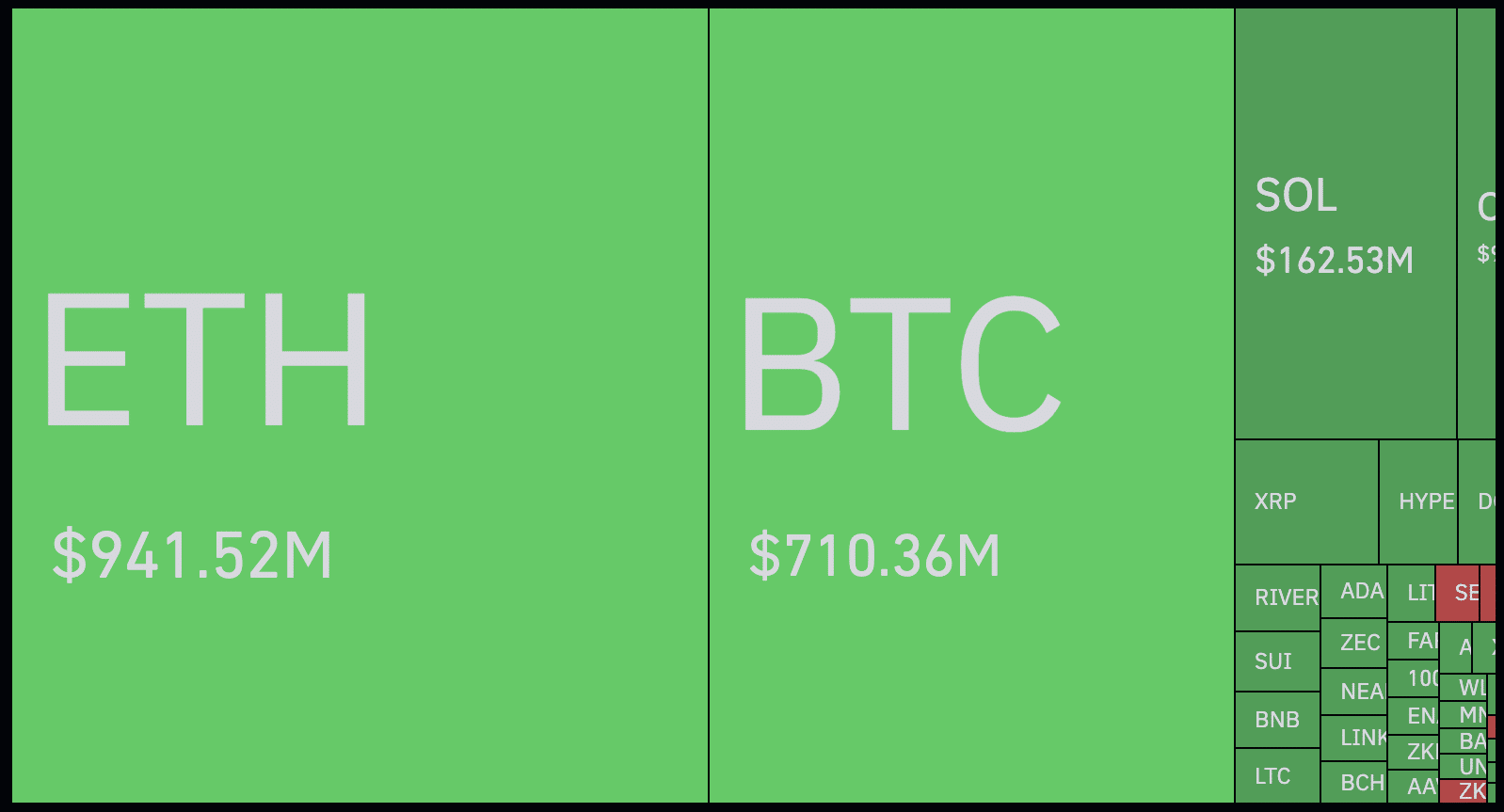

This move fits a broader risk-off mood tied to layoffs at AI-heavy tech firms and rising geopolitical tensions, which have wiped over $300Bn from the total crypto market cap since Friday (January 30).

JUST IN: $230,000,000,000 wiped out from the crypto market cap today. pic.twitter.com/ioonQaWM5J

— Watcher.Guru (@WatcherGuru) January 31, 2026

For everyday holders, this matters because Solana rarely drops alone. When the Bitcoin price drops, altcoins tend to follow, and harder, and SOL USD just slid in a big way.

The concern now is that Solana loses its key $100 level, a zone not seen since December 2023. Right now, it seems to be holding, but if next week brings more downside across the markets, SOL USD could test $100.

Why did SOL USD fall with Bitcoin, AI Stocks, and Metals?

This was not a Solana-only problem, and investors have spent this weekend dumping all crypto assets, as the sector is seen as extremely risky, while at the same time, AI stocks and gold also dropped sharply, with the precious metal falling -13% from its recent high.

Bitcoin USD is leading the way, dropping a further -3.5% overnight and crashing below $80,000, bringing the BTC price close to Michael Saylor’s average Strategy price of $76,000.

With Bitcoin trading at $81K and $MSTR‘s average price of $76K, @Saylor has earned just 6.5% over the past five years on the $54 billion he invested in Bitcoin. That’s about 1.3% per year. Bitcoin can’t even keep up with inflation. MSTR would have done better just buying T-bills.

— Peter Schiff (@PeterSchiff) January 31, 2026

What Does Extreme Trader Fear Look Like?

Millions vanished almost overnight for SOL USD traders. About $162M in long trades bets were wiped out overnight as prices fell fast.

The funding rate on SOL futures on Binance dropped to -0.2%, meaning traders are paying a fee just to stay short. That level of fear rarely lasts long.

Crypto Fear and Greed Chart

1y

1m

1w

24h

The panic in the market is evident in the Fear and Greed Index, which is at ’14’, in the Extreme Fear zone. This underscores traders’ bearish sentiment throughout crypto right now.

Until there is positive macroeconomic news for the markets, traders will likely continue to buy selectively, and as for leverage traders, bears are firmly in control of the charts.

BONUS: Is Maxi Doge (MAXI) the Perfect Tonic for Current Market Blues?

— MaxiDoge (@MaxiDoge_) January 19, 2026

Nothing can turn the market tides like a generational meme coin runner that prints millionaires overnight. It happened with DOGE, SHIB, PEPE, and many more, and Maxi Doge (MAXI) could be just what the market needs.

While the charts are getting destroyed, with billions wiped off the total market cap over the weekend, MAXI has been busy securing $4.55M in ICO funding.

Not only is the Maxi Doge project one of the most hyped memecoins in a long time, seen as the spiritual successor to the OG Dogecoin, but it also has the benefit of still being in the presale phase, and as a result, the token isn’t live and being killed by bearish market conditions.

Smart traders are choosing to park funds in the MAXI ICO, staking for a juicy 69% APY to grow their stack, and sit back and watch their bag grow while the rest of the market tanks.

Be part of the Maxi Doge community by joining the MAXI chads on X and Telegram, and get involved before it hits the open market and prices begin to fly.

EXPLORE: The 12+ Hottest Crypto Presales to Buy Right Now

Follow 99Bitcoins on X for the Latest Market Updates and Subscribe on YouTube for Daily Expert Market Analysis

The post SOL USD Slides to April 2025 Lows as Global Risk Assets Unwind appeared first on 99Bitcoins.