Strategy Stock Slides as Bitcoin Drops and MSTR Doubles Down

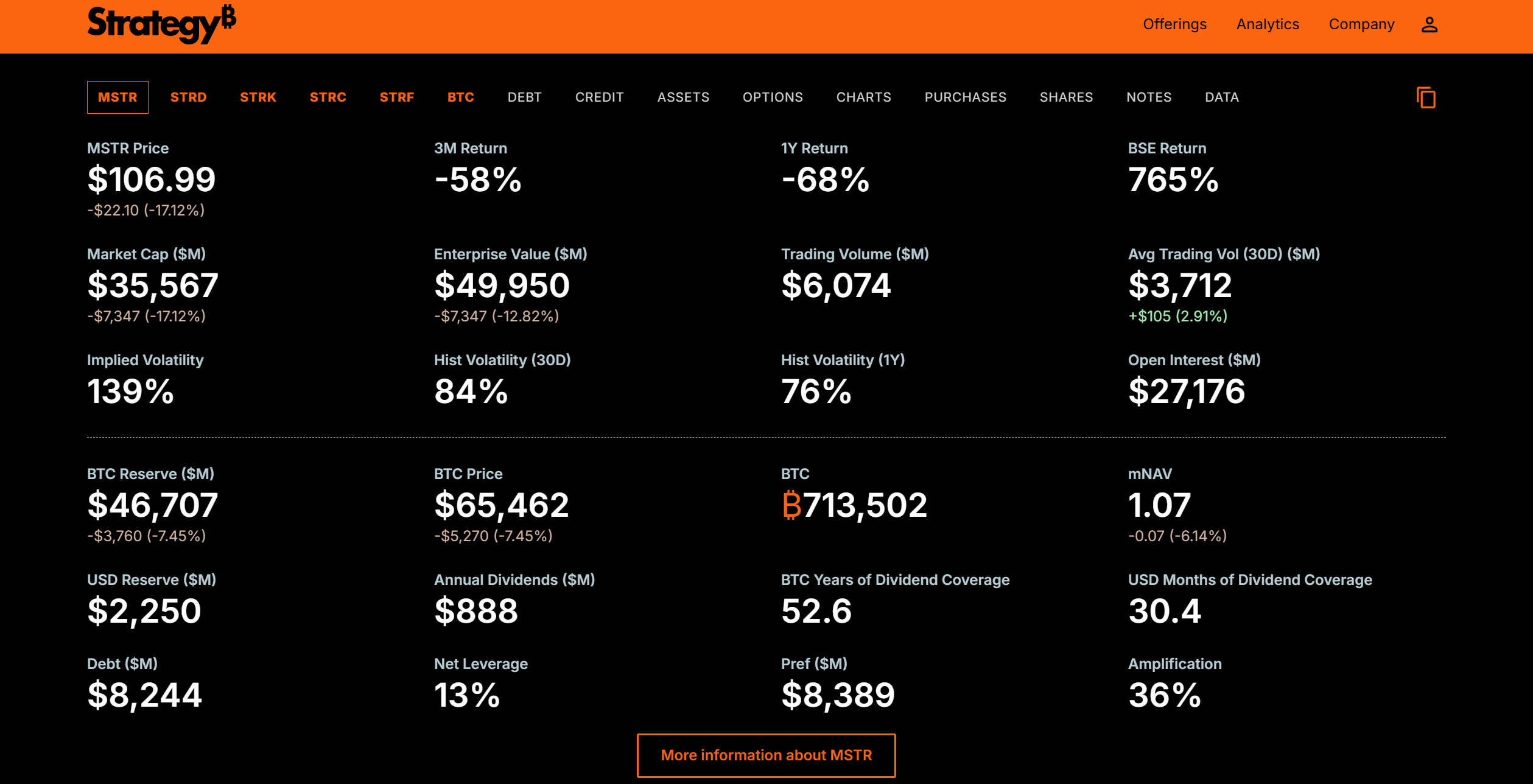

Strategy stock dropped sharply after Bitcoin slid over the weekend, dragging its crypto-heavy balance sheet lower and reminding investors how tightly the company moves with the price of BITCOIN USD. As Bitcoin dipped, MSTR fell even faster, reinforcing its reputation as a high-volatility proxy for the asset.

At the same time, the company signaled it continues to buy more Bitcoin, which adds another layer of tension for investors watching both markets closely.

This reaction fits a longer trend. Strategy has tied its future closely to Bitcoin during a period when institutions keep entering the space through ETFs and corporate treasury strategies, which increases both potential gains and the pressure during downturns.

Why Strategy Stock Moves Like A Leveraged Bitcoin Bet

Strategy, formerly MicroStrategy, holds more than 250,000 BTC, making it the largest corporate holder of Bitcoin. You can think of the company less as a traditional software business and more as a public stock tied directly to a large Bitcoin reserve.

That structure explains the sharp swings. MSTR tends to follow Bitcoin closely but amplifies the moves because the company used debt to acquire additional coins. When BITCOIN USD drops by a few percent, Strategy often falls further because investors factor in leverage and risk.

This dynamic attracts traders who want Bitcoin exposure through a regular brokerage account without dealing with wallets or exchanges, though it also increases volatility compared to holding Bitcoin directly.

DISCOVER: 9+ Best High-Risk, High-Reward Crypto to Buy in February2026

Why Michael Saylor Keeps Buying

Despite recent price declines, Michael Saylor continues to frame Bitcoin as a long-term digital property and views dips as buying opportunities. Strategy has raised billions through convertible notes and other financing tools to expand its Bitcoin position over time.

JUST IN: Michael Saylor says MicroStrategy can keep buying Bitcoin for 100 years and won’t get liquidated. Don’t buy the FUD — HODL

pic.twitter.com/8Oeyb25lwv

— Bitcoin Hopium (@BitcoinHopium) February 6, 2026

Public companies now hold a noticeable share of the total Bitcoin supply, with Strategy dominating that group. The company’s approach assumes that wider adoption of Bitcoin strengthens its long-term value, which explains why Bitcoin price drops often lead to more purchases rather than caution.

What This Means For Everyday Bitcoin Investors

For many beginners, Strategy stock looks like a convenient shortcut into crypto because it trades like any other stock and avoids the need for direct custody. That convenience comes with added complexity, as you are also exposed to corporate decisions, debt structure, and investor sentiment about the company itself.

Because of that structure, MSTR can fall more sharply than Bitcoin during downturns, especially when markets grow nervous about leverage or liquidity. Investors who want closer price tracking sometimes prefer spot Bitcoin ETFs, which follow BITCOIN USD more directly.

DISCOVER: Best New Cryptocurrencies to Invest in 2026

The Risk Many New Investors Overlook

Strategy’s model amplifies outcomes. Strong Bitcoin rallies can push the stock higher quickly, while rapid declines can lead to outsized losses as leverage compounds the pressure. This is why Bitcoin volatility risks matter more with proxy stocks than with Bitcoin itself, since you are adding another layer of complexity

Proxy stocks introduce another layer of risk beyond the underlying asset, making position sizing even more important. New investors often underestimate how different Bitcoin-linked stocks behave compared to holding Bitcoin itself.

Strategy’s stance remains consistent, as the company continues buying during weakness and treats volatility as part of the long-term plan, leaving investors to decide how much exposure and risk they feel comfortable carrying.

DISCOVER: 20+ Next Crypto to Explode in 2025

Follow 99Bitcoins on X for the Latest Market Updates and Subscribe on YouTube for Daily Expert Market Analysis

The post Strategy Stock Slides as Bitcoin Drops and MSTR Doubles Down appeared first on 99Bitcoins.