“Asia’s MicroStrategy” Metaplanet Increases Bitcoin Holdings With $6.7M BTC Purchase

Japanese investment firm Metaplanet has added another 108.78 Bitcoin (BTC) to its existing holdings, bringing its total reserves to over 639 BTC.

Metaplanet Unfazed By Bitcoin Price Movement

In an announcement made on October 7, 2024, Tokyo-based Metaplanet revealed that it had purchased an additional $6.7 million worth of Bitcoin, adding 108.78 BTC to its existing reserves.

The development comes at a time when geopolitical tensions in the world are at a rise, putting to test Bitcoin’s “global currency” narrative. However, some experts view this time as a buying opportunity for BTC, and Metaplanet’s actions appear to support this perspective.

It is also worth noting that October – historically a bullish month for BTC prices – has not had the best start this year. Nevertheless, bulls are confident of price gains toward the latter part of the month.

These developments appear to have little effect on Metaplanet’s Bitcoin thesis. Notably, the firm’s stock price surged following the latest BTC purchase, closing the day up 7.86%, with gains of 72 JPY (Japanese yen) or $0.49 USD.

Metaplanet has been on a Bitcoin buying spree this month, as it scooped up more than 107 BTC on October 1. Further, on October 3, the firm disclosed that it had earned around 23.9 BTC – worth almost $1.5 million at the time – by selling Bitcoin put options and collecting premiums.

Metaplanet’s total Bitcoin holdings now stand at almost 640 BTC, worth over $40 million according to current market price of $63,720. The latest purchase has also elevated Metaplanet to 17th position in the list of publicly-listed companies with Bitcoin holdings.

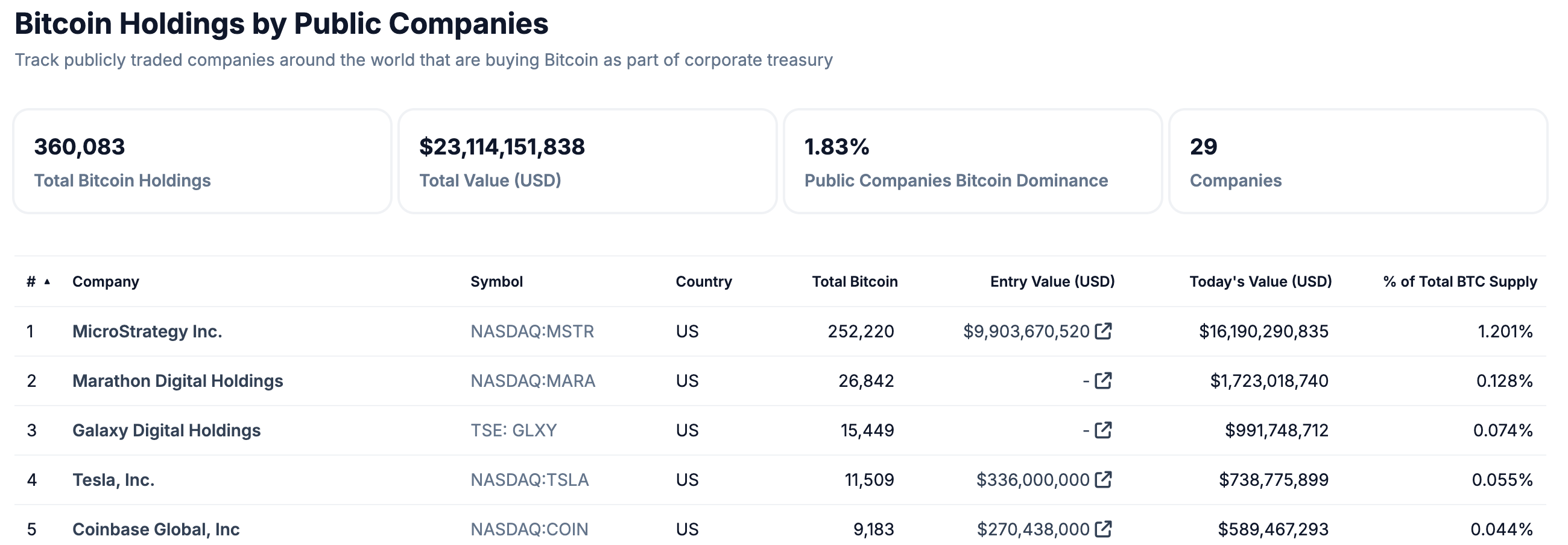

According to the list, companies with the largest BTC reserves are MicroStrategy, Marathon Digital Holdings, Galaxy Digital Holdings, Tesla, and Coinbase.

Japan Wants To Attract Crypto Capital By Easing Regulations

Japan, known for its receptive attitude toward new and emerging technologies, has not had the best experience with digital assets, particularly following the infamous Mt. Gox hack in 2014.

However, Japan has recently expressed a desire to overhaul its stringent crypto regulatory framework. This is not surprising, as a recent survey found that the majority of Japanese institutional investors are considering entering the crypto space within the next three years.

Earlier this month, Japan’s Financial Service Agency (FSA) shared plans to reform the country’s regulations toward crypto gaming to stimulate growth in the blockchain gaming sector.

On October 2, an insider from the FSA said the financial watchdog is considering reviewing existing digital asset regulations, potentially paving the way for a crypto exchange-traded fund (ETF) and lower taxes on crypto gains. At press time, BTC trades at $63,720, up 1.9% in the last 24 hours.